| |

The Indian Sugar Industry |

|

|

|

|

|

|

|

|

|

Indian sugar

industry is the 2nd largest agro-industry with

approximately 50 million sugarcane farmers and a large

number of agricultural laborers (7.5% of the rural

population) involved in sugarcane cultivation and ancillary

activities.

Though consumption of sugar in India has been growing at a

steady rate of 3%, and is currently at 23.1 million tones,

per capita consumption at 18 Kg (lower than world average of

22 Kg) indicates potential upside from a demand standpoint. |

| |

|

|

|

|

In India,

sugarcane is the key raw material, planted once a year

during January to March. It is the major cost driver for the

production of sugar. It being an agricultural crop is

subject to the unpredictable vagaries of nature, yielding

either a bumper crop or a massive shortfall in its

cultivation from year to year.

The sugarcane growing areas may be broadly classified into

two agro-climatic regions—subtropical and tropical. |

| |

|

Sub- Tropical zones |

Tropical zones |

-

Uttar Pradesh (UP)

-

Uttaranchal

-

Bihar

-

Punjab

-

Haryana

|

-

Maharashtra

-

Andhra Pradesh (AP)

-

Tamil Nadu (TN)

-

Gujarat

-

Karnataka

|

|

| |

| Maharashtra and

UP are the main cane producing states. |

| |

|

| |

|

|

|

|

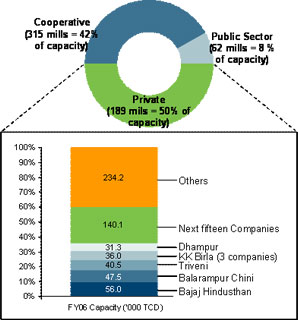

About 50% of the

sugar capacity is controlled by Cooperatives & Public sector

mills. There are 566 sugar mills installed in the country,

of which about 100 (mostly cooperatives) are not in

operation. Almost half of the operational sugar cooperatives

are in Maharashtra alone.

Though most private players have been moving towards larger

and integrated complexes, most cooperatives are still much

smaller in capacity, and are standalone sugar mills. This

has resulted in their becoming uncompetitive as compared to

private mills. |

| |

|

| |

|

|

|

|

Sugar has

historically been classified as an essential commodity and

has been regulated across the value chain. The heavy

regulations in the sector artificially impact the

demand-supply forces resulting in market imbalance.

Sensing this problem, since 1993 the regulations have been

progressively eased. The key regulatory milestones include

de-licensing of the industry in 1998 and the removal of

control on storage and distribution in 2002.

However, policy still plays an important role in the

industry. |

|

|

Legislation |

|

Sugarcane procurement |

- Concept of Command Area which binds Cane

farmers and Sugar mills to sell and buy from

each.

- Sugar mills have to purchase all the Cane sold

to them, even if it exceeds their requirement.

- In case of capacity expansions at existing

Sugar mills, there is uncertainty regarding

allocation of additional Area based on the

expanded capacity. |

|

Sugarcane pricing |

- Government administered Statutory Minimum

Price (SMP) which acts as a floor.

- States like UP, Haryana and Punjab fix a

higher price for cane, called the State Advised

Price (SAP). . Historically, the SAP has been as

high as 20-30% above SMP. |

|

Sugar sales |

- Government mandates 10% of sugar to be sold as

levy quota sugar at prices much lower than the

market.

- The government also specifies monthly release

quotas for free sale sugar. |

|

Capacity and Production |

- Sugar producers are not allowed to own cane

fields in India.

- New sugar mills cannot be set up within 15 km

of existing units. |

|

Exports & Imports |

- Imports of both raw and white sugar attract a

basic duty of 60% and a countervailing duty of

Rs. 910 per ton.

- In periods of sugar shortage, under the

Advanced License Scheme (ALS), license holders

can import raw sugar without paying any duty,

subject to the condition that they re-export

white sugar within a fixed period. |

|

Others |

- Restriction on Cogen PLF, currently only in

AP. |

|

|

|

|

|

|

| Source: ISMA,

SBI Capital Markets Limited report on sugar sector August

2006. |

| |

- As per government regulations, farmers are eligible

to sell their crop at Statutory Minimum Price (SMP).

Hence, their profit is impacted by differential between

SMP and the cost of cultivation, harvesting and

transportation, which are in turn dependent upon farm

productivity, labor availability, distance between farm

& market, mode of transport etc. Any price offered to

farmers over and above SMP is additional profit for

them.

- Since cane prices are governed by SMP, the drivers

for economic profits for the mills are the sugar prices

in domestic and international markets, milling costs and

by-product realizations. Lately due to depressed sugar

prices, there is an increased focus on cogen and

distillery products. This strategy enables better profit

realization and risk mitigation through product

diversification.

|

|

|

|

|

Like any other

agricultural product, cane production follows a cycle. This

impacts the sugar industry which has a typical of 4-5 year

cycle.

Higher sugarcane production results in a fall in sugar

prices and non-payment of dues to farmers. This compels the

farmers to switch to other crops causing a shortage, which

in turn results in increase in sugarcane prices and

extraordinary profit. Taking into account the higher prices

for cane, the farmers switch back to sugarcane, which

completes the cycle. |

|

| |

|

|

Production (1961-2007), Source: ISMA |

| |

|

|

|

|

Based on the

past ten years' growth in consumption and estimates from

various independent sources, it is expected that in 2017,

the domestic sugar consumption would be approximately 28.5

million MT. Given the high cost of imports and the strategic

importance of food security, India would need to target its

production in excess of domestic consumption. Given the past

trend in production cyclicality, sugar equivalent to 1.5

months of consumption i.e. an additional 3.5 million MT of

sugar would need to be produced by 2017. Therefore the

sector has huge investment potential.

In the near term (Sugar Season 2008-10), prices are expected

to go up as most mills had reduced their production due to

low sugar prices. |

| |

|

|

|

|

The new plants

which are being constructed are integrated complexes. This

would help in de-risking from

sugar downturns and benefit from untapped potential of

ethanol and cogen. For instance, while sugar capacities are

set to grow by 58%, Cogen and ethanol capacities are planned

to grow by 175% and 217% respectively. |

| |

|

|

|

| looking to

export refined and raw sugar to foreign markets. There are

two key factors that are driving this trade: |

- India is located close to major sugar deficient

markets. The Indian Ocean countries of Indonesia

Bangladesh, Sri Lanka, Pakistan, Saudi Arabia, UAE and

some East African countries are sugar deficient and

import sugar regularly.

- International trade has the potential to enable

stability in the domestic market and is promoted by the

government.

|

| |

|

|

| |